The Congressional Research Service (CRS) has issued information about the updated thresholds for the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) for 2024.

The updated information is contained in an annual report the CRS issues concerning the WEP and the GPO. Both are benefit formulas that reduce Social Security benefits for workers and their eligible family members if the worker receives (or is entitled to) a pension based on earnings from employment not covered by Social Security.

The Windfall Elimination Provision

The WEP dates from 1983, when it was enacted as part of major amendments intended to bolster the financing of Social Security. The WEP reduces the Social Security benefits of certain retired or disabled workers who are also entitled to pension benefits based on earnings from jobs that were not covered by Social Security—and thus not subject to the Social Security payroll tax.

The WEP is intended to remove an unintended advantage or “windfall” that these workers would otherwise receive as a result of the interaction between the regular Social Security benefit formula and the workers’ relatively short careers in Social Security-covered employment.

The WEP applies to most people who receive a pension from noncovered work (including certain foreign pensions) as well as Social Security benefits based on fewer than 30 years of substantial earnings in covered employment or self-employment. The WEP affects retired- or disabled-worker beneficiaries and their eligible dependents—but it does not affect survivor beneficiaries.

In December 2023, about 2.1 million people—approximately 3% of all Social Security beneficiaries—were affected by the WEP. The vast majority—nearly 2 million—of those people were retired-worker beneficiaries, approximately 4% of all retired worker beneficiaries. The remaining affected persons were disabled-worker beneficiaries and eligible family members of retired- or disabled-worker beneficiaries.

2024 Levels. For purposes of the WEP, the amount of substantial earnings in covered employment or self-employment needed for a year of coverage (YOC) is adjusted annually by the growth in average earnings in the economy, provided a cost-of-living adjustment is payable. In 2024, the amount of substantial earnings in covered employment or self-employment needed for a YOC is $31,275.

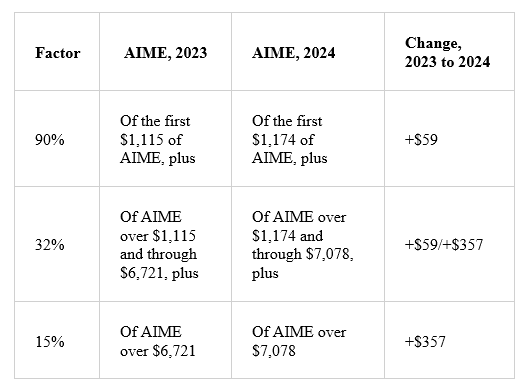

The regular Social Security benefit formula applies three factors—90%, 32%, and 15%—to three different brackets of a worker’s average indexed monthly earnings (AIME), which is a measure of career-average earnings in covered employment or self-employment. The result is the primary insurance amount (PIA), which is the worker’s basic benefit before any adjustments are made for factors such as COLAs, early retirement, or delayed retirement. For workers who become eligible for benefits in 2024, the PIA is determined based on the formula below.

Social Security Benefit Formula for Workers Who Attain Age 62, Become Disabled, or Die in 2024, Compared With 2023

Factor

For people with 20 or fewer YOCs who become eligible for benefits in 2022, the WEP reduces the first factor from 90% to 40%, resulting in a maximum reduction of $587 (90% of $1,174 minus 40% of $1,174). For each year of substantial earnings in covered employment or self-employment in excess of 20 years, the first factor increases by 5%. For example, the first factor is 45% for those with 21 YOCs. The WEP factor reaches 90% for those with 30 or more YOCs and at that point is phased out.

The Government Pension Offset

The GPO is intended to replicate the dual entitlement rule for spouses and widow(er)s who receive pensions based on noncovered employment.

The GPO reduces the Social Security spouse’s or widow(er)’s benefits of most people who also receive a pension based on federal, state, or local government employment not covered by Social Security. It provides benefits to the spouses and widow(er)s of insured workers, because immediate family members are presumed to be dependent on a worker for their financial support and thus are presumed to be in need of such benefits when the family experiences a loss of income due to the worker’s retirement, disability or death. In general, a spouse receives up to 50% of the worker’s PIA, and a widow(er) receives up to 100%.

In December 2023, the GPO reduced benefits for 745,9679 Social Security beneficiaries—approximately 1% of all beneficiaries. Of those directly affected by the GPO, 51% were spouses and 49% were widow(er)s. The GPO fully offset benefits for about 68% of all GPO-affected beneficiaries, and partially offset benefits for approximately 32% of them.

- Log in to post comments