An increasing body of research and results seem to confirm that state-sponsored retirement plans—and auto-IRAs specifically—close the coverage gap, not only by providing a public option but also by encouraging higher private plan adoption.

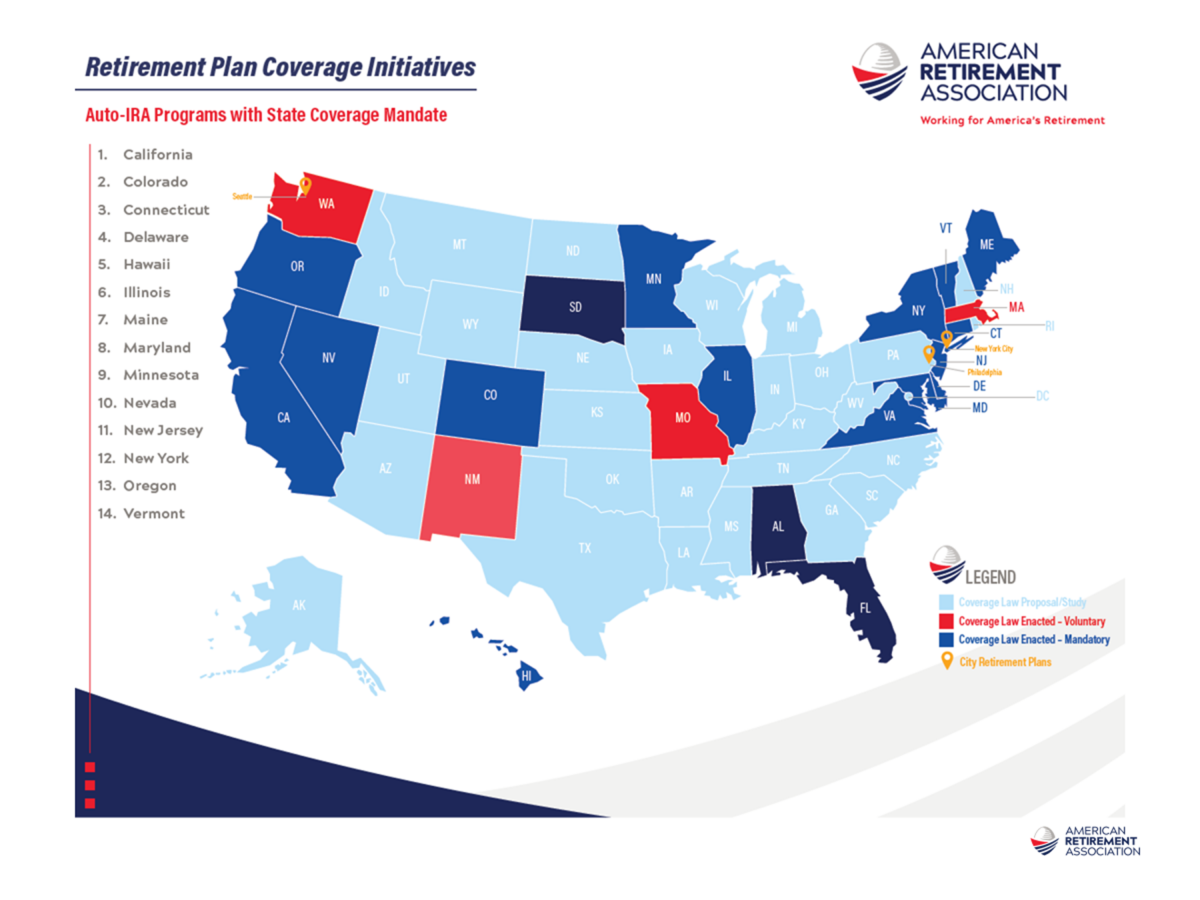

Currently, 14 states have a mandate in place, with another four that have enacted voluntary programs.

In states with auto IRAs, private-sector employers are more likely to offer their own plans, and workers are more likely to participate, according to Angela Antonelli, Executive Director of the Center for Retirement Initiatives (CRI) at Georgetown University’s McCourt School of Public Policy. It’s a public/private partnership that works, she added, and is sorely needed.

Antonelli noted that more than 57 million employees lack access to a retirement plan in their workplace. The coverage gap disproportionately affects small businesses due to costs, administration, and other responsibilities. It also disproportionately affects women and people of color.

The Georgetown CRI’s mission is to be “a trusted public policy center, recognized for its research, education, information, and convenings that promote innovation in retirement plan and program design, including state-facilitated retirement savings programs.”

It recently announced a roster of high-profile retirement plan policy experts to serve on its 2024 Advisory Council, including Former DOL EBSA Assistant Secretary Phyllis Borzi, TIAA Institute Head Surya Kolluri, and Will Hansen, Chief Government Affairs Officer with the American Retirement Association.

PGIM Managing Director Josh Cohen, State Street Global Advisors Managing Director Melissa Kahn, AARP Government Affairs Director Jessica Eckman, Hank Kim, Executive Director of the National Conference on Public Employee Retirement Systems (NCPERS), and Andrea Feirstein, Managing Director of AKF Consulting Group round out the council.

Antonelli recently pointed to new auto IRAs offered by Minnesota, Nevada, and Vermont as examples of recent wins and the momentum the issue currently has.

She added that some were passed by Democrat legislators and signed by Republican governors, further proof of the bipartisan nature of retirement planning and saving.

“Even saving a modest amount can make a difference, and starting sooner and saving longer makes a difference,” she concluded. “It also allows workers to delay Social Security, resulting in a higher benefit amount.

- Log in to post comments