For the IRS, fiscal year (FY) 2023 “was a transitional year,” largely due to funding provided under the Inflation Reduction Act of 2022 and application of technology, according to Commissioner of Internal Revenue Danny Werfel. His made his remarks in the agency’s most recent data book, an annual report outlining certain enforcement and compliance-related activities.

The IRS 2023 Data Book covers IRS activity during the period Oct. 1, 2022-Sept. 30, 2023. The data it provides includes information on returns filed, collections, enforcement, taxpayer assistance, and other selected activities—including those related to retirement plans.

A ‘Transitional Year’

Werfel said that the transitions were due to long-term funding provided under the Inflation Reduction Act, a measure whose effects he said began to become evident in FY 2023. He said the IRS began its first investments of that funding in compliance operations, including hiring additional staff to more adequately address areas of noncompliance.

“This transformation is critical to the future of the IRS and our nation and will benefit IRS employees, individual taxpayers, businesses, the tax community, tax-exempt organizations and many others in the years to come,” he asserted in the introduction.

Part of that transformation included application of technology. Said Werfel, in FY 2023 the IRS “continued to make progress developing and using innovative approaches to better understand, detect and resolve potential noncompliance, such as leveraging new technology and data analytics to fairly enforce the tax laws.”

Voluntary Compliance Closures

The IRS in FY 2023 continued to have a strong commitment “to maintaining a visible, robust tax enforcement presence to appropriately support taxpayers and promote fairness in the tax system” regarding compliance, said Werfel.

Part of the IRS effort to encourage compliance is providing mechanisms by which taxpayers can voluntarily correct errors and make disclosures, in the process heading off formal enforcement actions. The IRS reports that the number voluntary compliance closures—that is, instances of voluntary compliance action that were resolved—by retirement plans increased from 2022 to 2023. In FY 2022, there were 1,059 such case closures; in FY 2023, there were 1,142.

Form 5500 Series

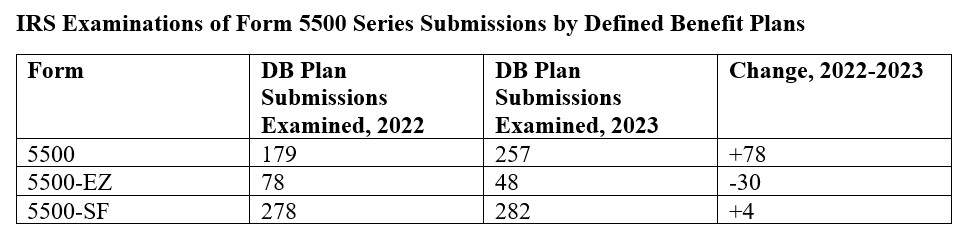

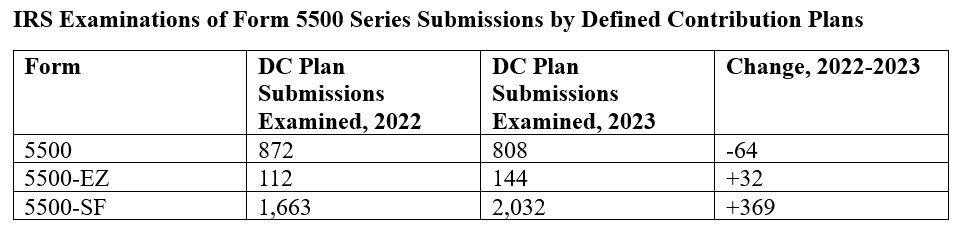

IRS examination of Form 5500 Series forms that retirement plans filed was roughly unchanged from 2022 to 2023. IRS examination of Forms 5500-SF showed the greatest and broadest increase.

Determination Letters

The IRS sent more determination letters to retirement plans in FY 2023 than in FY 2022, In FY 2023, it sent 1,296; in FY 2022 it had issued a total of 1,235.

The growth was highest regarding the number of determination letters the IRS sent concerning employee stock ownership plans (ESOPs) and those concerned profit-sharing plans. In 2022, it sent 285 concerning ESOPs; in 2023, 316. And the number of determination letters it sent concerning profit-sharing plans roughly doubled from 95 to 186.

- Log in to post comments