For the next 10 years, the Social Security trust funds will have a positive balance. But balance sheet solvency after that will be another matter, says the Congressional Research Service (CRS).

In its latest Social Security Primer, updated Oct. 2, 2023, the drumbeat the CRS hits is little different from those of the recent past: the system faces long-term challenges.

The CRS reports that according to the Social Security Board of Trustees, the Social Security system maintained a total surplus from 2010 through 2020, but beginning in 2021 total costs exceeded total revenues. Further, the trustees project that Social Security expenditures will exceed tax revenues each year pretty much to the end of the 21st century; more exactly, they make that projection through the end of the 75-year valuation period ending in 2097.

Where Things Stand

The CRS report says that in 2022, the combined Social Security trust funds amounted to $1.22 trillion, expenditures came to $1.24 trillion and accumulated holdings (assets) amounted to about $2.83 trillion.

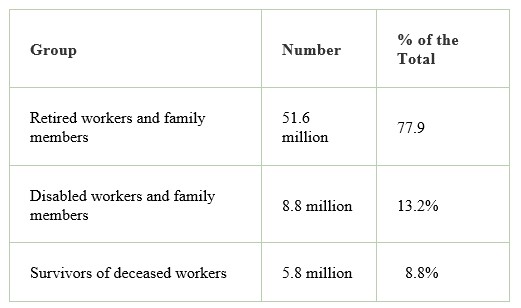

In 2023, the annual limit on taxable earnings is $160,200. As of February 2023, there were approximately 66.2 million Social Security beneficiaries; almost 78% of them were retired workers and family members; just over 13% were disabled workers and family members, and nearly 9% of beneficiaries were deceased workers’ survivors.

Beneficiaries by the numbers:

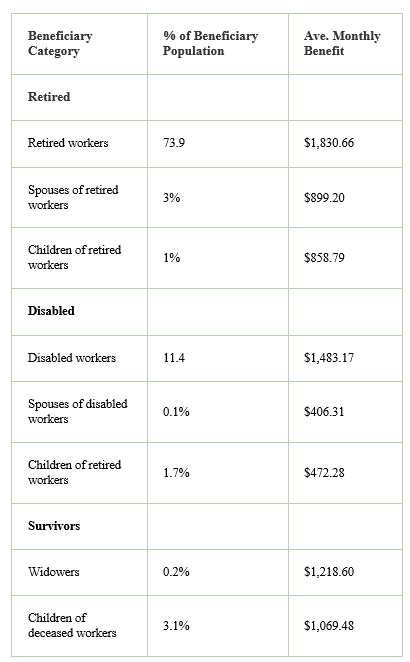

The beneficiaries further broke down in this way:

The Crystal Ball

One measure by which the Social Security Trust Fund can be gauged is through the trust fund ratio, which represents trust fund assets at the beginning of a year as a percentage of cost for the year. In 2023, projected trust fund ratio is 204%; that is, assets held by the trust funds at the beginning of 2023 are projected to be 2.04 times greater than the cost of the program in 2023. The trustees project that the trust fund ratio will decline to 96% in 2029 and reach zero when the trust fund reserve has been depleted in 2034.

Nonetheless, all is not lost, the report indicates.

The report says that after the trust fund reserves are depleted, the Social Security program will continue to operate with incoming Social Security receipts. Those receipts are projected to be sufficient to pay 80% of benefits scheduled under current law in 2034, and that incoming Social Security receipts would still be sufficient to pay 74% of scheduled benefits in 2097.

But for Now…

Despite the gathering gloom, says the CRS, in the short run the trustees say that the Social Security trust funds—namely, the Federal Old-Age and Survivors Insurance (OASI) Trust Fund and the Federal Disability Insurance (DI) Trust Fund—will have a positive balance (that is, asset reserves) until 2034.

In short, that means that Social Security benefits scheduled under current law will be paid in full and on time. That is, until 2034, at least under current projections.

- Log in to post comments