While inflation and market volatility eased somewhat over the past year, that hasn’t necessarily resulted in a boost to American workers’ retirement and financial confidence.

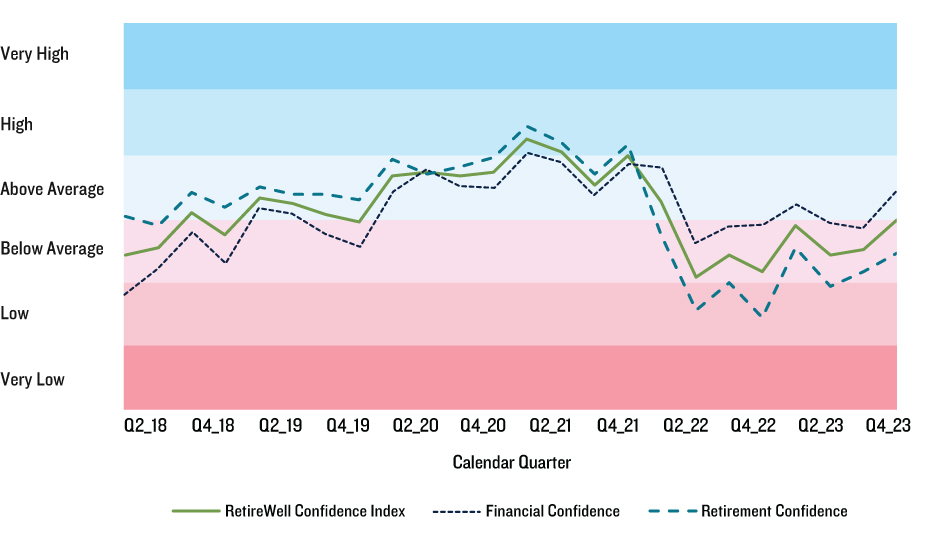

According to PGIM’s new RetireWell Confidence Index, workers’ retirement and financial confidence have lingered at “below average” levels since the second quarter of 2022.

According to PGIM’s new RetireWell Confidence Index, workers’ retirement and financial confidence have lingered at “below average” levels since the second quarter of 2022.

PGIM, which is the global asset management business of Prudential Financial, also reports that individuals approaching retirement (between 45 and 59 years of age) had the lowest average retirement confidence score (37) among age groups in the fourth quarter of 2023. According to PGIM, this emphasizes the importance of personalization when it comes to financial advice and retirement solutions, as age alone often doesn’t tell the full story.

In addition, the gap between financial confidence and retirement confidence has widened dramatically since the start of 2022, which could indicate that while investors may feel relatively secure in their investments today, they worry greatly about the future, the firm further observes.

“2022 was a relatively traumatic year for investors, where both stocks and bonds experienced double-digit losses. This is incredibly rare, historically,” explained David Blanchett, PGIM DC Solutions portfolio manager and head of retirement research. “If the economy keeps doing relatively well, I wouldn’t be surprised if financial confidence meets or exceeds 2021 levels at some point in 2024, but it will clearly take some time before retirement confidence returns to where it was,” he added.

The 2022 dive in retirement confidence coincides with the start of one of the most turbulent years for investors, with the S&P 500 index losing approximately 19.4%—which was one of the worst years for equities since 2008—in addition to pressures from high inflation and interest rate hikes. Not only was 2022 a tough year for stocks, but bonds also had one of their worst years on record, leaving few safe places for investors to park their money, the firm notes.

Updated on a quarterly basis, the PGIM RetireWell Confidence Index provides a breakdown of retirement and financial confidence scores across age and household income levels, ranging from 0 (low confidence) to 100 (high confidence). The index is based on over 300,000 completed responses to a financial wellness assessment survey offered by Prudential Financial through a group insurance benefits platform or through a DC plan since 2018. The index controls for the demographic factors related to confidence, such as age, income, gender and marital status, and provides context as to how sentiment has evolved over time. There are six potential confidence levels: very high, high, above average, below average, low, and very low.

“We see the PGIM RetireWell Confidence Index as a value-add for employers who want a better understanding of how American workers are thinking and feeling about retirement and their finances in general, noted Michael Miller, head of PGIM DC Solutions. “Our goal is to offer this wellness assessment more broadly, so that we can provide companies with plan-level insights to improve financial wellness over time.”

The index is part of PGIM’s RetireWell Solutions, a suite of tools, products and solutions developed to help DC plan participants achieve better retirement outcomes through holistic advice and guidance.

Visit the PGIM RetireWell Confidence Index for additional information.

- Log in to post comments